Preparing for the Recovery

– Thoughts on finding opportunities based on the market’s reaction to a COVID-19 vaccine

(This is for education only, no recommendations.)

The market may have tipped its hand when surmising which stocks could lead to recovery when a true solution to the coronavirus is widely available.

On Monday, Pfizer announced positive news regarding its vaccine causing a rally in particular stocks. When the reality of when it would actually be available set in, many of these stocks started moving back down.

How might we look for an opportunity using some simple code in Cincom Smalltalk™?

Step 1 – Find the good “pops.”

(Find the top 10% rises in the S&P 500 from October 30th to the highest close up to November 13th.)

symbols := Index spx500Symbols.

pop := IdentityDictionary new: symbols size.

symbols do:[:sym | pop at: sym put: sym security popPercentChange ].

popKeys := pop keysSortedByValueDescending first: 10 percent.

Step 2 – From the step 1 group, find the “drops.”

(Find the biggest drops starting with the biggest drops list from step 1.)

popDrop := IdentityDictionary new: symbols size.

popKeys do:[:sym | popDrop at: sym put: sym security popDropPercentChange ].

popDropKeys := popDrop keysSortedByValueDescending first: 50 percent.

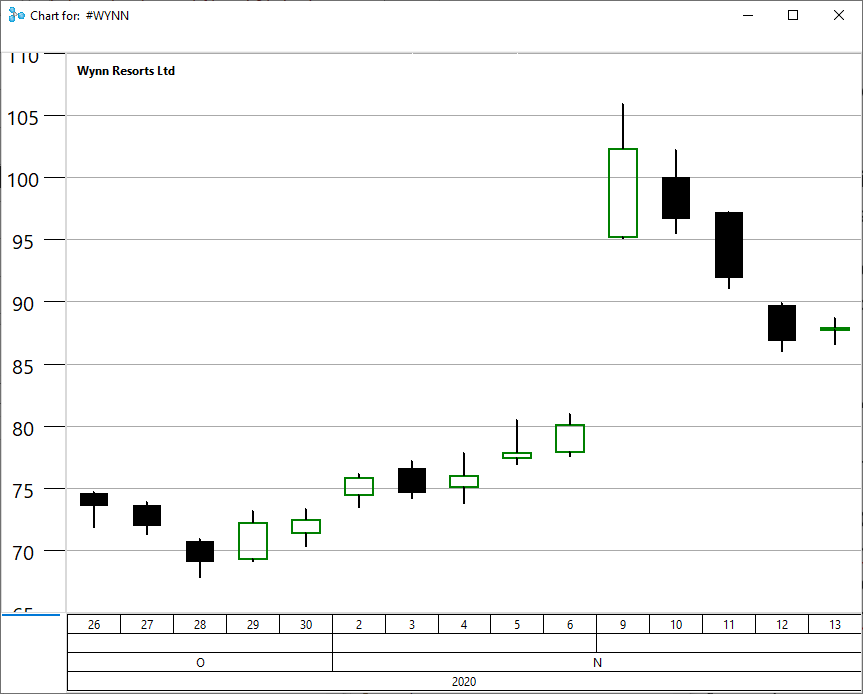

As an example, popDropKeys includes WYNN.

Executing a couple of Smalltalk expressions tells us that WYNN “popped” 41% and then “dropped” 48% of that gain.

#WYNN security popPercentChange 41.15

#WYNN security popDropPercentChange 48.20

I will cover this in detail in upcoming editions of the “Quantitative Gems” series. Please send comments to athomas@cincom.com. See the full Quantitative Gems series here.